An investment in gold neither pays as much as most think nor does it pay as often as recent returns suggest.

After crossing the mark of Rs.50,000 per 10 grams a few weeks ago, gold prices were around Rs. 55,000 at the time of writing. In fact, gold prices have increased by 40% in the first 8 months of this year already. Silver, another precious metal, has also increased from Rs. 50.3 per gram to Rs. 71 per gram this year.

Given how 2020 has turned out, does it mean that gold prices will reach new highs? With FDs, debt funds, and other safe assets barely beating inflation after taxes, should you increase your allocation to gold? Let us answer all these and more.

But first, a little background.

As this article explains, since it is neither as common as iron nor as rare as rhodium, gold has just the right level of scarcity. Add to that, its inert nature, durability, and other physical properties have historically made it a great store of value.

In the modern economy, what makes gold important is that it does well when other assets do badly. With bonds in Europe giving negative yields and US government bonds not far behind, gold appears to be the only safe asset with acceptable returns. Across the globe, including in India, banks are discouraging deposits and making it easier to borrow money.

So what is the catch?

If you bought 10 grams of gold in 1980 for Rs. 1158 and sold it for Rs. 55,000 today, your investment would have grown at 10.13% per annum. Given how gold has performed recently, you might think that it is a realistic return and settle for this ROI. After all, who doesn’t want a buy-it-and-forget-it type of investment?

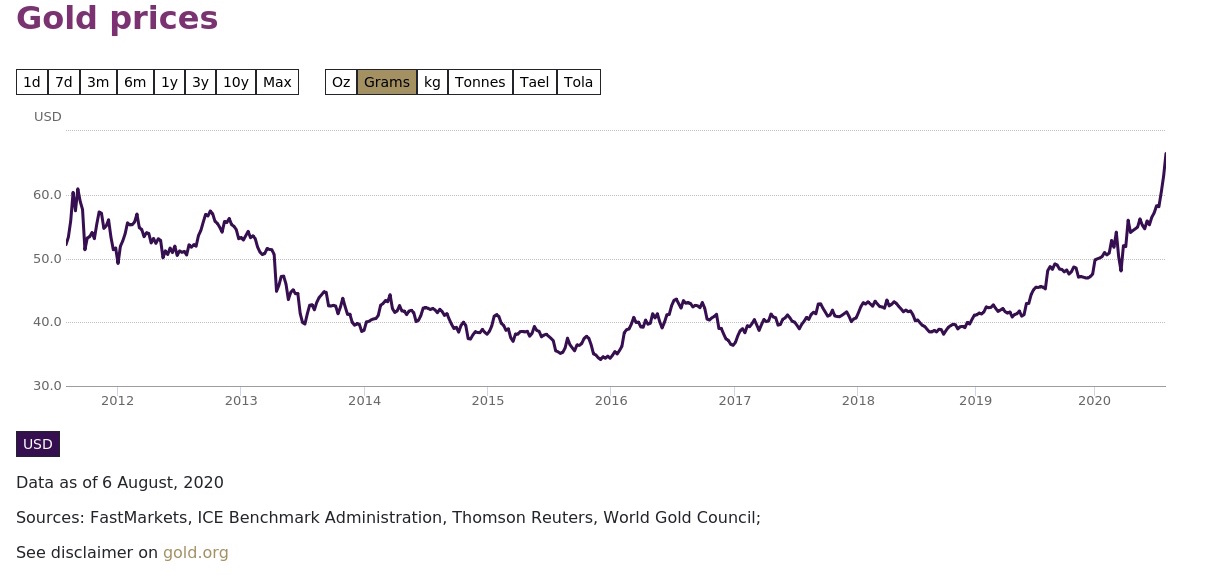

But the above paragraph doesn’t mention the most crucial aspect of gold prices — they remain stagnant for long periods and increase in spurts. To illustrate this, the last time gold prices saw a similar rally was in August 2011 when gold prices reached Rs. 28,000 per 10 grams. In the next 7 years, until January 2019, gold prices increased only 14% to reach 32,000. Contrary to popular belief, prices also fell a little in the years between this period.

It must also be noted that the price of gold in India depends on the exchange rate with the US Dollar. As given in the graph below, the price of gold in international markets fell dramatically between 2011 and 2018. However, the effect was canceled out in India as the exchange rate for 1USD increased from Rs. 45 to Rs. 71 during the same period.

Source: World Gold Council

So should you buy or sell gold?

The role of gold in your portfolio is not to replace equity but to absorb shocks in times like these. Therefore, its share should be no more than 10-15% of your portfolio. The performance of gold will depend on the following factors –

- Since gold thrives in uncertainty, any news of herd immunity, vaccine, or anything that eases the uncertainty will apply brakes on the gold rally.

- Will the rupee depreciate against the dollar?

- How are you investing in gold? For instance, even if you are able to overlook the sentiments attached to gold jewelry, it is still an expensive way to own gold.

- If you can sell gold, make enough returns, and not wonder about future returns, you can book your profits and move to a different asset.