The most complicated law provisions as the general public may find it, the reverse charge mechanism aims at plugging the loophole and bringing to tax net almost everyone.

What is Reverse Charge?

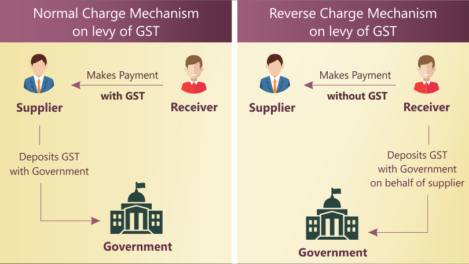

Reverse Charge means the liability to pay tax is on the recipient of the supply of goods or services instead of the supplier of such goods or services in respect of notified categories of supply.

In simple words, you receive goods and services and instead of paying tax to the supplier, you directly pay to the government.

Types of Reverse Charge

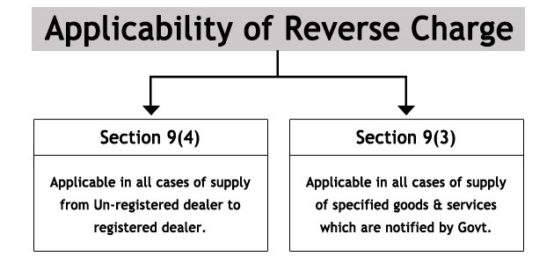

There are two typed of Reverse Charge:

- Compulsory List: Specific as Notified by Govt: First is dependent on the nature of supply and/or nature of supplier. This scenario is covered by section 9 (3) of the CGST/SGST (UTGST) Act and section 5 (3) of the IGST Act.

- General List: Second scenario is covered by section 9 (4) of the CGST/SGST (UTGST) Act and section 5 (4) of the IGST Act where taxable supplies by any unregistered person to a registered person is covered.

Exemption From Reverse Charge:

Whenever a registered person procures supplies from an unregistered supplier, he needs to pay GST on reverse charge basis. However, supplies, where the aggregate value of such supplies of goods or services or both received by a registered person from any or all the unregistered suppliers is less than five thousand rupees in a day, are exempted.

However, vide notification no.38/2017-Central Tax (Rate) dated 13.10.2017, (corresponding IGST notification no.32/2017-Integrated Tax (Rate) dated 13.10.2017) all categories of registered persons are exempted from the provisions of reverse charge under 9(4) of CGST / SGST (UTGST) Act, 2017 / section 5(4) of IGST Act, 2017, till 31.03.2018. This exemption is available only till 31.03.2018.

Implications of Reverse Charge Provision:

As per the provisions of section 9(3) of CGST/SGST (UTGST) Act, 2017/section 5(3)of IGST Act, 2017, the Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Similarly, section 9(4) of CGST/SGST (UTGST) Act, 2017/section 5(4) of IGST Act, 2017 provides that the tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person, shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Registration

Threshold Limit Not applicable: A person who is required to pay tax under reverse charge has to compulsorily register under GST and the threshold limit of Rs. 20 lakhs (Rs. 10 lakhs for special category states except J & K) is not applicable to him.

Input Tax Credit not Available: ITC A supplier cannot take ITC of GST paid on goods or services used to make supplies on which the recipient is liable to pay tax.

Time of Supply

The time of supply is the point when the supply is liable to GST.

One of the factors relevant for determining the time of supply is the person who is liable to pay tax. In reverse charge, the recipient is liable to pay GST. Thus, time of supply for supplies under reverse charge is different from the supplies which are under forward charge.

In case of supply of goods, time of supply is earliest of: –

(a) date of receipt of goods; or

(b) date of payment as per books of account or date of debit in the bank account, whichever is earlier; or

(c) the date immediately following thirty days from the date of issue of invoice or similar other documents.

In case of supply of services, time of supply is earliest of: –

(a) date of payment as per books of account or date of debit in the bank account, whichever is earlier; or

(b) the date immediately following sixty days from the date of issue of invoice or similar other documents.

Where it is not possible to determine the time of supply using above methods, the time of supply would be the date of entry in the books of account of the recipient.

COMPULSORY LIST

- Supplies of goods under reverse charge mechanism:

| S/ No. | Description of supply of Goods | Supplier of goods | Recipient of Goods |

| 1 | Cashew nuts, not shelled or peeled | Agriculturist | Any Registered person |

| 2 | Bidi wrapper leaves (tendu) | Agriculturist | Any registered person |

| 3 | Tobacco leaves | Agriculturist | Any registered person |

| 4 | Silk yarn | Any person who manufactures silk yarn from raw silk or silkworm cocoons for supply of silk yarn | Any registered person |

| 4A | Raw cotton | Agriculturist | Any registered person. |

| 5 | Supply of lottery | State Government, Union Territory or any local authority | Lottery distributor or selling agent |

| 6 | Used vehicles, seized and confiscated goods, old and used goods, waste and scrap | Central Government, State Government, Union territory or a local authority | Any registered person |

- Supplies of services under reverse charge mechanism:

| S/ No. | Description of supply of Service | Supplier of service | Recipient of service |

| 1 | IMPORT OF SERVICES: Any service supplied by any person who is located in a non-taxable territory to any person other than the non-taxable online recipient. | Any person located in a non-taxable territory | Any person located in the taxable territory other than the non taxable online recipient. |

| 2 | GTA Services | Goods Transport Agency (GTA) | Any factory, society, cooperative society, registered person, body corporate, partnership firm, casual taxable person; located in the taxable territory Reverse Charge Mechanism in GST |

| 3 | Legal Services by advocate | An individual advocate including a senior advocate or firm of advocates | Any business entity located in the taxable territory |

| 4 | Services supplied by an arbitral tribunal to a business entity | An arbitral tribunal | Any business entity located in the taxable territory |

| 5 | Services provided by way of sponsorship to any body corporate or partnership firm | Any person | Any body corporate or partnership firm located in the taxable territory( NOT APPLICABLE TO PROPRIETORS) |

| 6 | Services supplied by the Central Government, State Government, Union territory or local authority to a business entity excluding, – (1) renting of immovable property, and (2) services specified below- (i) services by the Department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Central Government, State Government or Union territory or local authority; (ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; (iii) transport of goods or passengers. | Central Government, State Government, Union territory or local authority | Any business entity located in the taxable territory |

| 7

| Services supplied by a director of a company or a body corporate to the said company or the body corporate | A director of a company or a body corporate | The company or a body corporate located in the taxable territory |

| 8

| Services supplied by an insurance agent to any person carrying on insurance business | An insurance agent | Any person carrying on insurance business, located in the taxable territory |

| 9

| Services supplied by a recovery agent to a banking company or a financial institution or a non-banking financial company | A recovery agent | A banking company or a financial institution or a non-banking financial company, located in the taxable territory |

| 10 | Services supplied by a person located in non- taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India | A person located in non-taxable territory | Importer, as defined in clause (26) of section 2 of the Customs Act, 1962(52 of 1962), located in the taxable territory |

| 11 | Supply of services by an author, music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright-covered under section 13(1) (a) of the Copyright Act, 1957 relating to original literary, dramatic, musical or artistic works to a publisher, music company, producer or the like

| Author or music composer, photographer, artist, or the like

| Publisher, music company, producer or the like, located in the taxable territory Reverse Charge Mechanism in GST

|

| 12 | Supply of services by the members of Overseeing Committee to Reserve Bank of India | Members of Overseeing Committee constituted by the Reserve Bank of India | Reserve Bank of India. |

Compliances in respect of supplies under reverse charge mechanism:

- As per section 31 of the CGST Act, 2017 read with Rule 46 of the CGST Rules, 2017, every tax invoice has to mention whether the tax in respect of supply in the invoice is payable on reverse charge. Similarly, this also needs to be mentioned in receipt voucher as well as refund voucher, if the tax is payable on reverse charge.

- Maintenance of accounts by registered persons: Every registered person is required to keep and maintain records of all supplies attracting payment of tax on reverse charge

- Any amount payable under a reverse charge shall be paid by debiting the electronic cash ledger. In other words, reverse charge liability cannot be discharged by using input tax credit. However, after discharging reverse charge liability, the credit of the same can be taken by the recipient, if he is otherwise eligible.

- Invoice level information in respect of all supplies attracting a reverse charge, rate-wise, are to be furnished separately in table 4B of GSTR-1.

- Advance paid for reverse charge supplies is also leviable to GST. The person making advance payment has to pay tax on a reverse charge basis.